The second half of the season got underway on Thursday, kicking off an 11-week sprint to the postseason.

For the top teams in the league, the next week and a half will present an opportunity to bolster their roster for the stretch run, while those clubs having disappointing seasons will likely spend that time looking to make moves to improve their outlook for the future. The following 22 teams appear to have set their course for this year’s Trade Deadline:

Buyers (13): Astros, Blue Jays, Braves, Brewers, Cardinals, Dodgers, Mariners, Mets, Padres, Phillies, Rays, Twins, Yankees

Sellers (9): Angels, Athletics, Cubs, D-backs, Nationals, Pirates, Reds, Royals, Tigers

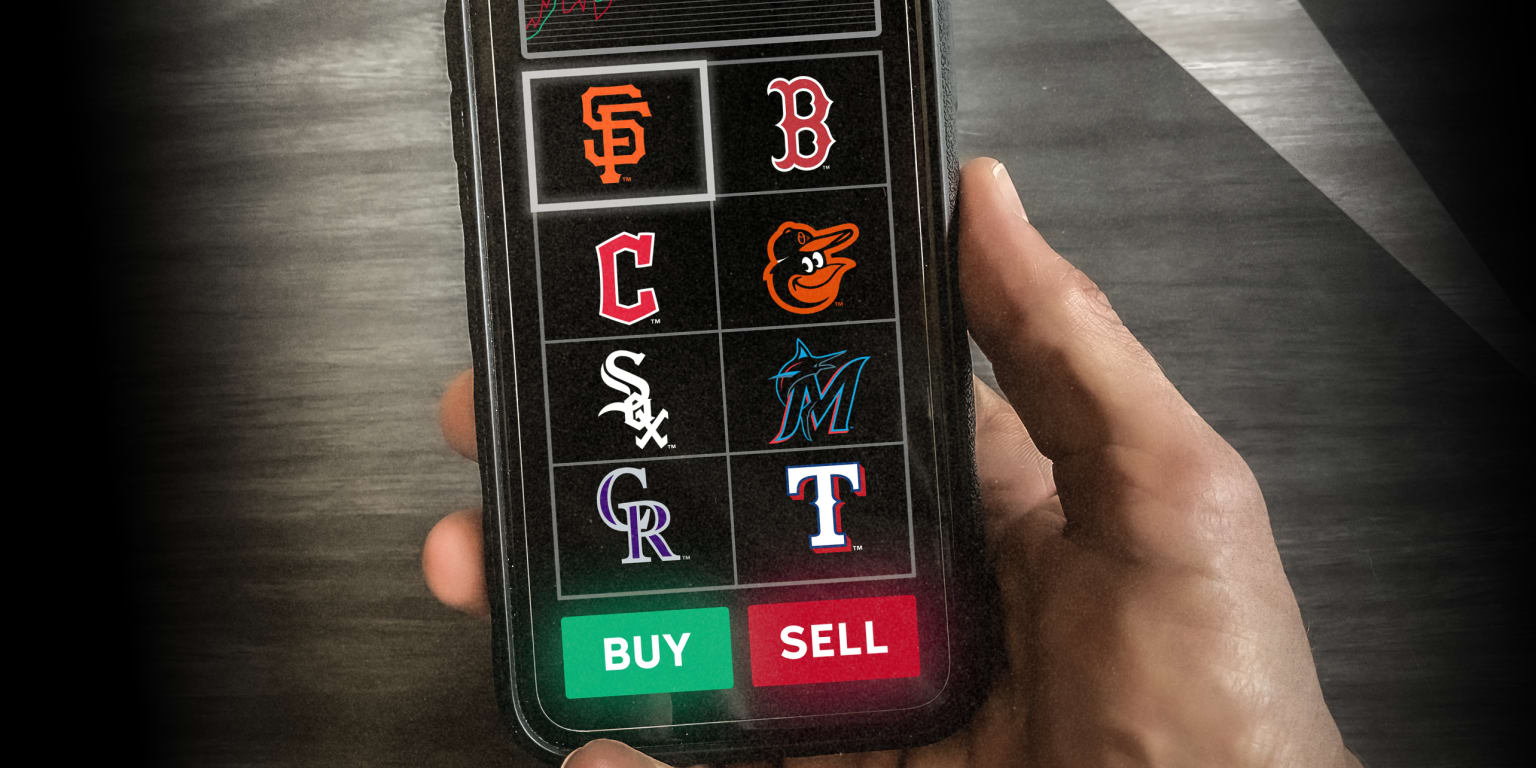

But what about those teams in the middle?

With six postseason spots in each league this season, identifying buyers and sellers has become trickier than ever. Some executives might choose to do a little bit of both, dealing away prospects or expiring contracts for big league players with control beyond 2022. Others might simply stand pat, believing that their teams are one winning streak away from being a postseason threat.

Here’s a look at the eight teams currently on the bubble and whether they might emerge as buyers, sellers or both (listed in order of first-half record).

Giants president of baseball operations Farhan Zaidi has been loath to sell in past years, the most notable example coming in 2019. The Giants started the season 35-47, leading most to believe it was a near-certainty that free-agent-to-be Madison Bumgarner would be dealt prior to the Trade Deadline. San Francisco went on a run that moved the club into the Wild Card picture, as Zaidi said the final 10 days before the Deadline would determine the team’s course.

The Giants, who entered the final day of July just one game over .500, wound up hanging on to Bumgarner and All-Star closer Will Smith, though Zaidi also made five trades on Deadline day — dealing away some other bullpen pieces while adding 2018 All-Star Scooter Gennett. The next week could very well determine the course Zaidi takes this year, as the Giants remain in the Wild Card mix despite a huge deficit in the NL West.

Red Sox (48-45)

Boston was 14-22 in mid-May, sparking talk of a massive summer fire sale including the likes of impending free agents J.D. Martinez and Nathan Eovaldi, not to mention Xander Bogaerts, who is expected to opt out of his contract and become a free agent at the end of the season. By the end of June, the Red Sox were 43-33, putting them in the top AL Wild Card spot. The fire sale was on hold.

July has reignited the trade talk; Boston lost 12 of 17 games heading into the All-Star break, dropping them two games behind the Blue Jays for the third and final Wild Card spot. It’s difficult to imagine the Red Sox throwing in the towel if they’re only a couple games back in the days leading to the Deadline, but with Chris Sale out indefinitely following finger surgery, the boost the club expected from the ace’s return is no longer an option.

A good week could push Red Sox chief baseball officer Chaim Bloom to explore trades for a starter, reliever and first baseman, while a bad week could mean the end for Bogaerts, Martinez and/or Eovaldi in Boston.

Guardians (46-44)

After a 46-44 first half, Cleveland looks like a team destined to flirt with the .500 mark all season. The good news for the Guardians is that despite their uneven year, they entered the break just two games behind the first-place Twins in the AL Central and 2 1/2 games out of a Wild Card spot.

The majority of the roster is under control beyond 2022, though Amed Rosario — who is arbitration-eligible for the final time next winter — could be moved to bring back a starting pitcher or perhaps a catcher. Regardless of what the next week looks like, it seems unlikely that Cleveland’s front office will make any huge moves one way or the other, letting the current group take its shot at punching a ticket to October.

Orioles (46-46)

The fact that the Orioles are even on this list is incredibly impressive, as Baltimore plays in the toughest division in the game and was projected by many before the season as a 100-loss team. With a 27-37 record in mid-June, there was little reason to think that impending free agent Trey Mancini would be on the roster past Aug. 2, while Anthony Santander and Jorge López (two more years of arbitration each) also figured to be on the trade block.

Since then, the Orioles are 19-9 (including a 10-game winning streak), improbably pulling their record back to .500 to thrust them into the AL Wild Card mix, just 3 1/2 games out of the final spot. It seems unlikely that Orioles executive VP and GM Mike Elias would deal away any of the team’s prospect capital for short-term help, but that doesn’t mean the Orioles are destined to be sellers. Baltimore could make moves for controllable assets with an eye on 2023 and beyond, though the idea of trading fan-favorite Mancini, Santander and/or López feels improbable given the excitement the team’s latest run has created with the fan base.

White Sox (46-46)

The White Sox have been the picture of mediocrity for most of the season, never falling lower than five games below .500 and never moving more than four games over. Chicago has been as many as 6 1/2 games out of first place in the AL Central, but the middling state of the division has kept a White Sox team that entered the year with great expectations in the postseason mix.

The rotation ranks ninth in the AL in ERA, while the bullpen ranks 10th. The offense? It ranks ninth in the AL in OPS and 11th in home runs. The fact that Chicago entered the break just three games out of first place and 3 1/2 out of a Wild Card should keep the Sox from selling – not that they have many expiring contracts to move. The farm system entered the season ranked No. 30 by MLB Pipeline, which didn’t include a single White Sox prospect in its Top 100 list. For better or worse, Chicago’s roster looks like it might not change all that much, though the Sox will try to add a left-handed bat and a lefty reliever if possible.

Marlins (43-48)

The first of three sub-.500 teams on this list, the Marlins opened the season with a winning April (12-8) before hitting the skids in May (7-19). Miami was three games over .500 from June 1 through the break, leaving the Marlins 5 1/2 games out of the final NL Wild Card spot.

If Kim Ng decides to become a seller, she should have myriad teams calling on players such as Jesús Aguilar (2023 mutual option), Anthony Bass (2023 club option) and Garrett Cooper (arbitration-eligible in 2023). The Marlins were ranked as the sixth-best farm system in the game by MLB Pipeline, with six prospects in the Top 100. Four of the top six are pitchers, so if another club overwhelms Miami with an offer for a controllable arm such as Pablo López, the Marlins might have to consider it.

Rockies (43-50)

A nice start out of the gate had the Rockies hopeful that they could contend for a postseason berth despite the loss of Trevor Story this past offseason, but May (10-17) and June (11-17) left them 10 games under .500 and potentially thinking about next season.

Colorado opened July with 10 wins in 17 games prior to the break, including a five-game winning streak last week. The Rockies remain on the outskirts of the Wild Card race (6 1/2 games back as of the break), though their minus-62 run differential is the worst of any team in either league within 7 1/2 games of a Wild Card spot. If Colorado sells, players such as José Iglesias, Chad Kuhl. Daniel Bard and Alex Colomé — all impending free agents — could become available.

Rangers (41-49)

Texas entered the break 7 1/2 games out of a Wild Card spot, but unlike the Rockies, the Rangers’ minus-1 run differential suggests they should be better than 41-49. After signing Corey Seager, Marcus Semien and Jon Gray this offseason, the Rangers were hopeful that they could compete for a postseason spot, and given that the vast majority of the club remains under control beyond this season, Texas feels like a “stand pat” type of team as of now.

Should the Rangers draw closer to a playoff spot between now and the Deadline, it’s possible the club would try to make a pitching upgrade or two in both the rotation and bullpen. Texas was ranked by MLB Pipeline as the No. 9 farm system in the league prior to the season, though it would be shocking to see the Rangers trade away any of their top prospects unless they can land a controllable starter such as Luis Castillo or Frankie Montas.